Sports betting: is it necessary to declare them for tax purposes?

Winning a few dozen euros has no tax consequences.

But should bettors who win four or five figures have to declare them for tax purposes? If so, how are they taxed?

This week, we dive into the bookmakers’ business.

Taxation of gambling winnings: do you have to declare your bets?

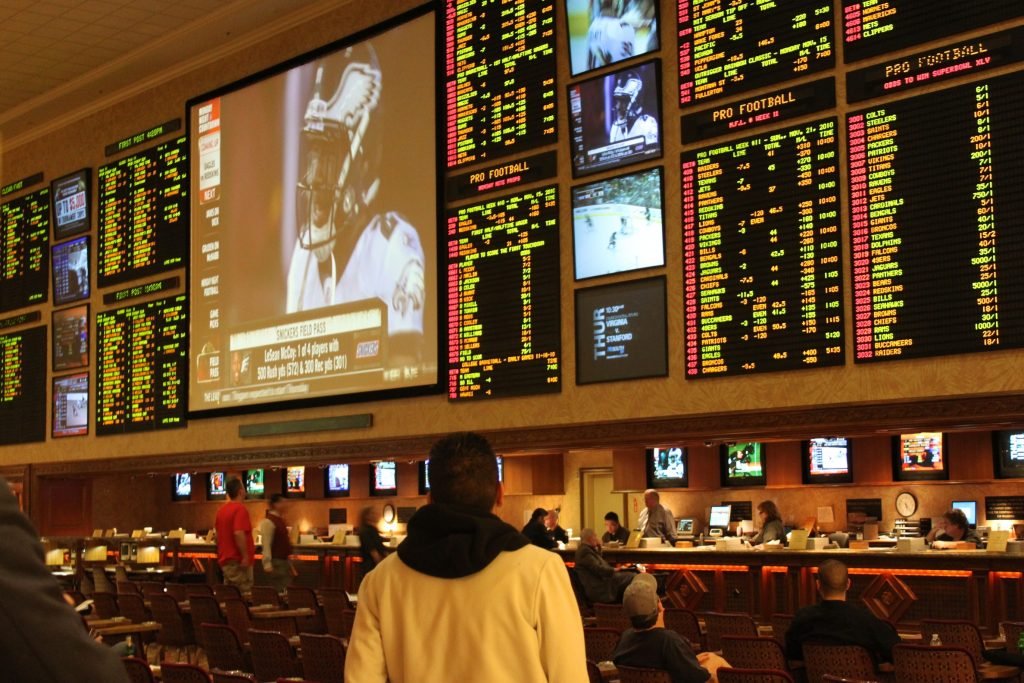

We will have understood it. In addition to being the subject of all conversations, major sporting events such as the World Cup are also (and above all) an opportunity to bet on matches. An activity that is becoming more and more widespread, especially in the professional world. After a complicated start when it was launched in early 2010, the organization of betting between colleagues is gradually becoming part of the corporate culture. The objective for the organizers is not to play bookmakers but to stimulate team spirit and create a good atmosphere. Moreover, from the point of view of the law, there is no need to worry, as Mr. Reynaud, a lawyer in the Strasbourg office, states:

“There is no problem in organizing sports betting as long as the intermediary is not financially interested.

While it is the favorite of amateur gamblers, soccer is not the only sport to boost the growth of online gambling. Horse racing, ice hockey competition, combat sports, etc., the industry is experiencing unprecedented growth. One of the reasons for this success is the fact that gambling winnings are, in principle, tax-free. “In principle”, because in France, gambling winnings are traditionally not included in the tax base. They do not constitute income, such as a salary or pension. Unless the gambler has made it his profession. It is the application of article 92 of the CGI which relates to the BNCs:

“All occupations, lucrative exploitations and sources of profits not related to another category of profit or income. »

When are gambling winnings taxable?

The tax authorities do not consider gambling winnings to be the product of a lucrative occupation. The Council of State has been clear on this point; winnings are not taxable, even if they exceed the amount of the bettor’s other resources. An assertion that must have reassured many Turfists.

In short, if you had bet 100 francs on an L2 match once in 1987, there would be little chance that the taxman would come after you. If you’re a professional poker player and play several tournaments a week, it’s different.

It is a very important point to note that the “winnings made by professional players under conditions that eliminate or strongly reduce the randomness normally inherent in games of chance”.

The balance swings: if it is classified as a game of chance, the rules in force for the taxation of poker winnings are the same as for Lotto (CRDS and IFI). If it is a strategy game, then it must be taxed like any other professional activity and the winnings must be declared as Non-Commercial Profits (NCB).

Sports betting and taxes: 1-0 for Bercy

But back to our balloons. Unlike poker, soccer matches are considered pure chance. In spite of the real predictive qualities of a few regular winners, no one can predict the outcome. The victory of South Korea against Germany (2 – 0) on June 27th is proof of this.

The logic is the same as with horse racing. The outcome of a sporting event remains too random for bettors to be classified as professionals. It would seem counter-intuitive, on the other hand, to classify these games as games of skill or strategy.

Moreover, it is not because gambling and betting winnings are not to be declared that they are not taxed. In the case of sports betting, bookmakers are required to pay 7.5% of the sums committed by bettors to Bercy and social security. This figure partly explains why redistribution rates are lower in France than elsewhere.